Welcome to Albion Forest Mortgages

Simple Mortgage advice that you can trust

At Albion Forest Mortgages we cover the whole of the UK. We can help you with your mortgage online, by phone or face to face.

You voluntarily choose to provide personal details to us via this website. Personal information will be treated as confidential by us and held in accordance with GDPR May 2018 requirements. You agree that such personal information may be used to provide you with details of services and products in writing, by email or by telephone. By submitting this information you have given your agreement to receive verbal contact from us or one of our trusted partners to discuss your mortgage requirements

Latest Mortgage News

Can someone give me a deposit for a mortgage

Everything you need to know about Deposits in 2024. You voluntarily choose to provide personal details to us via this website. Personal information will be

How much deposit do I need for a mortgage

Everything you need to know about Deposits in 2024. You voluntarily choose to provide personal details to us via this website. Personal information will be

Mortgage Rates in 2024

Everything you need to know about Mortgage rates in January 2024. You voluntarily choose to provide personal details to us via this website. Personal information

Getting a Mortgage In The New Forest

Our ultimate guide to getting a mortgage in the New Forest. Everything you need to know. You voluntarily choose to provide personal details to us

7 income sources you can use for a mortgage

Our ultimate guide to what income you can use for a mortgage. Everything you need to know. You voluntarily choose to provide personal details to

Mortgage Deposits for First Time Buyers

Our ultimate guide to First time buyer deposits for a mortgage. Everything you need to know. You voluntarily choose to provide personal details to us

Albion Forest – Making Mortgages as easy as 1, 2, 3…

Get in touch – Speak to an advisor and we’ll give you expert advice to suit your needs.

Apply for your mortgage – Your personal expert Mortgage Advisor will apply for your mortgage.

Get your mortgage and more importantly, your home!

Refer-A-Friend

If you know someone that can benefit from our help you can send them over to us, and when their mortgage completes we’ll give you a whopping £50 Amazon Voucher.

(Just make sure to let us know you’ve referred them or we won’t know to send over your voucher!)

Terms & Conditions:

- There is only one voucher issued per person

- There are no restrictions on the number of referrals made

- The voucher is non-transferable and there is no cash alternative

- The voucher will be sent to you after completion of the mortgage of the new client and their fee being received by Albion Forest Ltd

- If we receive a referral from multiple sources for the same mortgage application, the voucher will go to whichever referral we receive first

- Albion Forest reserves the right to amend, vary or cancel these terms and conditions at any given time

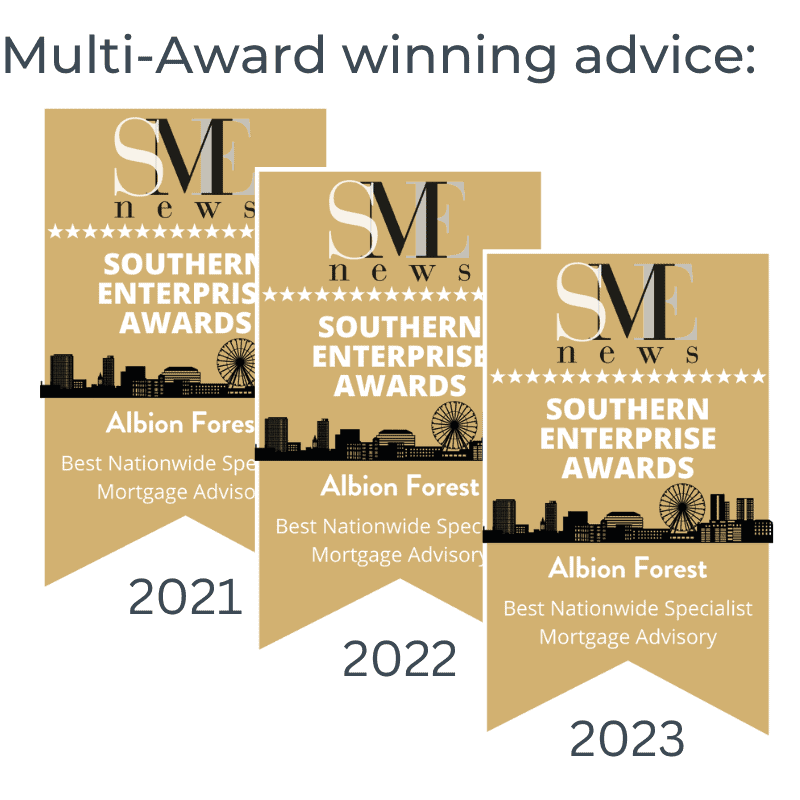

Award Winning Advice

We are proud to have won awards for our work in the financial services industry.

- SME News Awards – Best Nationwide Specialist Mortgage Advisory 2021

- SME News Awards – Best Nationwide Specialist Mortgage Advisory 2022

- SME News Awards – Best Nationwide Specialist Mortgage Advisory 2023

- Nominated – South Coast Business Awards 2022 – Small Business Award